The Federal Reserve decided to exercise patience. Fed Chair Jerome Powell was absolutely clear about this. Unlike previous FOMC meetings, where he asserted that the federal funds rate would be lowered at some point in 2024, this time it was different. Powell expressed uncertainty regarding the timing for a potential rate cut. He began to set conditions for easing monetary policy. For instance, in case unemployment rises too much. However, the reaction of the EUR/USD was quite surprising.

Markets approached the FOMC meeting with a sense of fear. There were rumors that the Fed, unsatisfied with the pace of inflation and the financial conditions, would make a strong hawkish pivot. Either Powell would directly announce the possibility of rate hikes, or he would suggest it. For instance, by announcing the irrelevance of the March forecasts of three acts of monetary easing. None of this happened. On the contrary, the Fed chair's statement that monetary tightening is unlikely had triggered a stock rally and a decline in bond yields. The EUR/USD managed to rise for this reason.

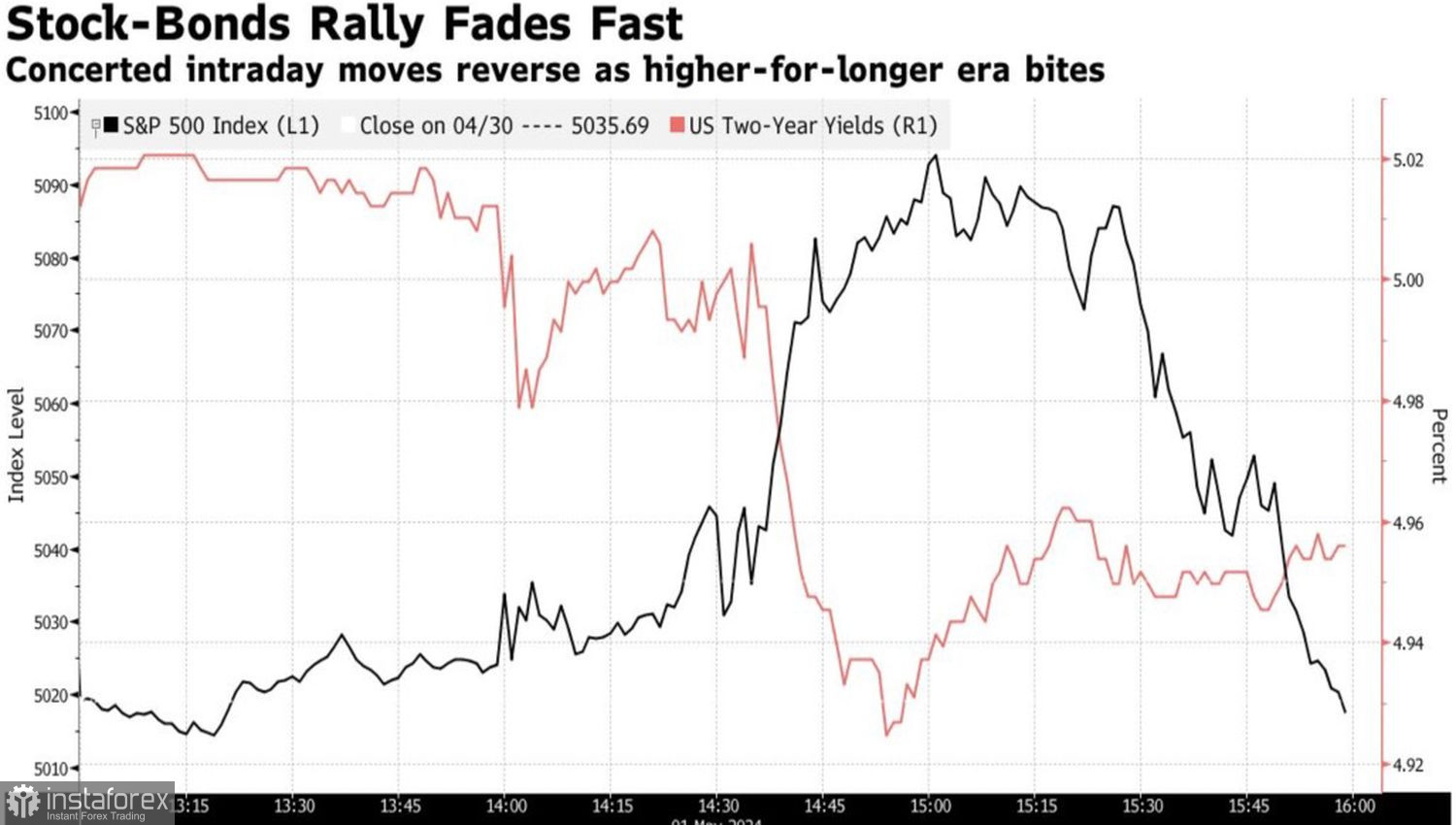

Reaction of the S&P 500 and US Treasury Bond Yields to the FOMC Meeting

However, the euro bulls did not celebrate for long. The S&P 500 ultimately closed the day in the red, and US bond yields rose. Maintaining the federal funds rate at a plateau of 5.5% for longer than anticipated is not very good news for risky assets. On the contrary, safe havens, including the US dollar, should feel comfortable.

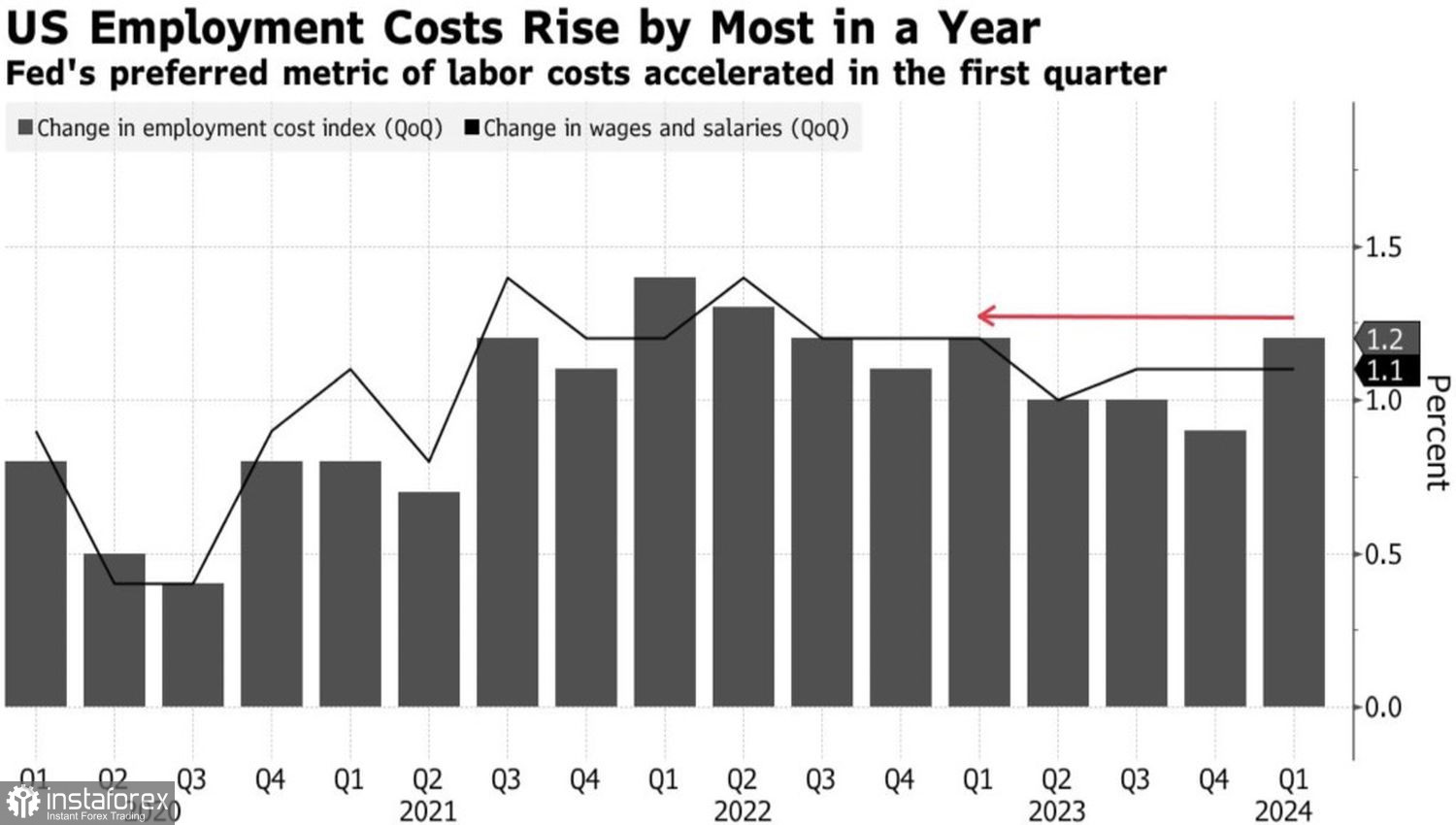

In reality, Powell didn't present any surprises, and the Fed asserts that inflation will slow down. Even if the road ahead may be bumpy. However, markets fear that this will be replaced by a statement that inflation has anchored at 3%. Monetary policy is data-dependent, so it's not surprising that annual-high wage costs made it possible for the EUR/USD bears to attack.

Dynamic of Wage Costs in the US

Now investors are eyeing the US labor market data. Economists surveyed by Bloomberg forecast a 240,000 gain in payrolls, while the unemployment rate will remain at 3.8%. This is quite decent statistics, which will allow the Fed to remain idle. In China, there is a proverb that if you do nothing, everything may happen by itself. Perhaps the Fed is counting on this. Passivity is a good remedy for mistakes. If they lower the federal funds rate, inflation could accelerate; if they raise it, the economy could sink into recession. It's better to just observe what's happening.

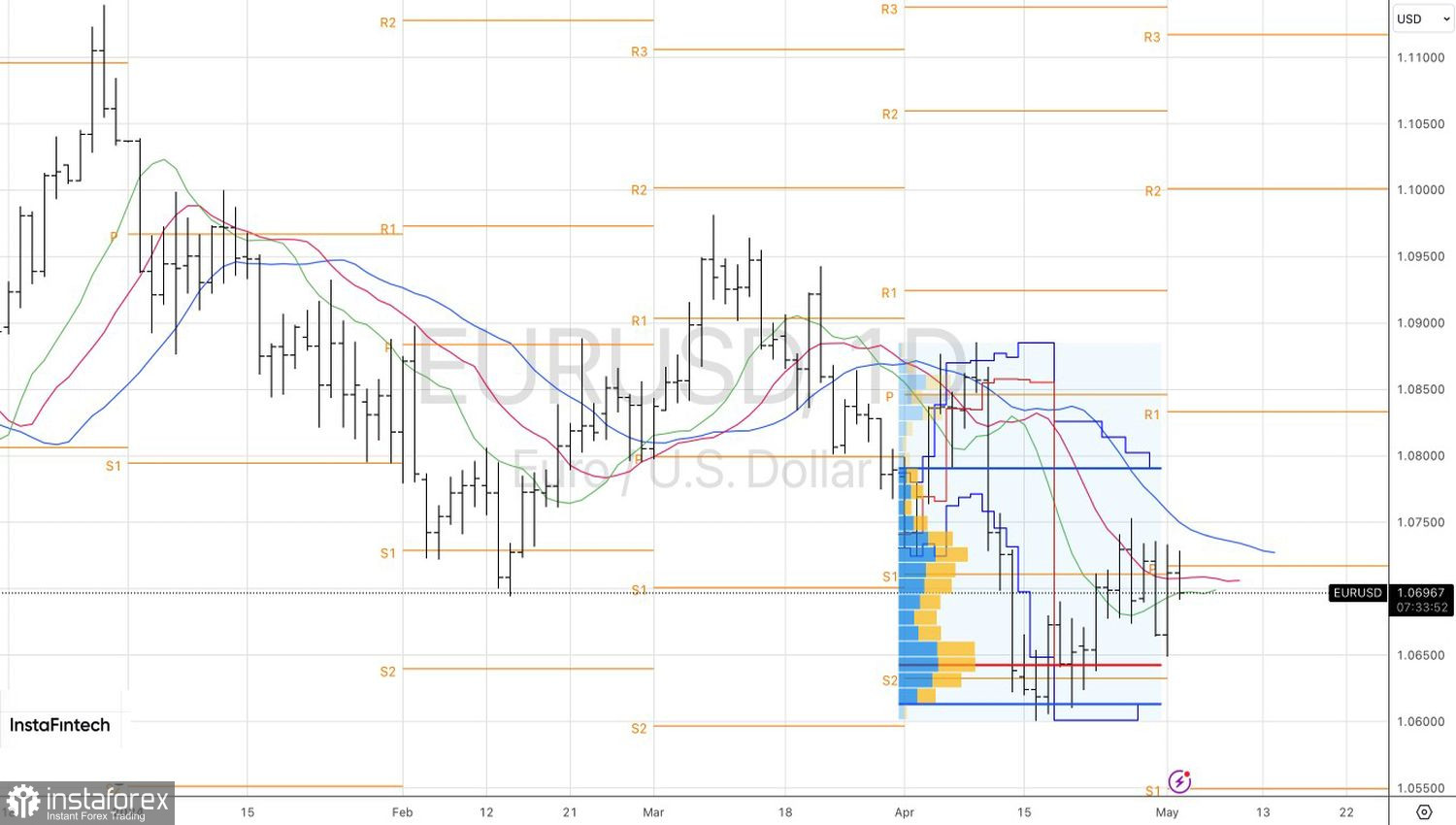

Technically, on the daily chart, the EUR/USD is consolidating in a zone of dynamic support and resistance accumulation in the form of moving averages. Quotes above the pivot level of 1.072 will increase the risks of a bullish pullback. Conversely, a decline below $1.069 and $1.065 will make it possible to count on further downward movement towards $1.06 and $1.05.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română