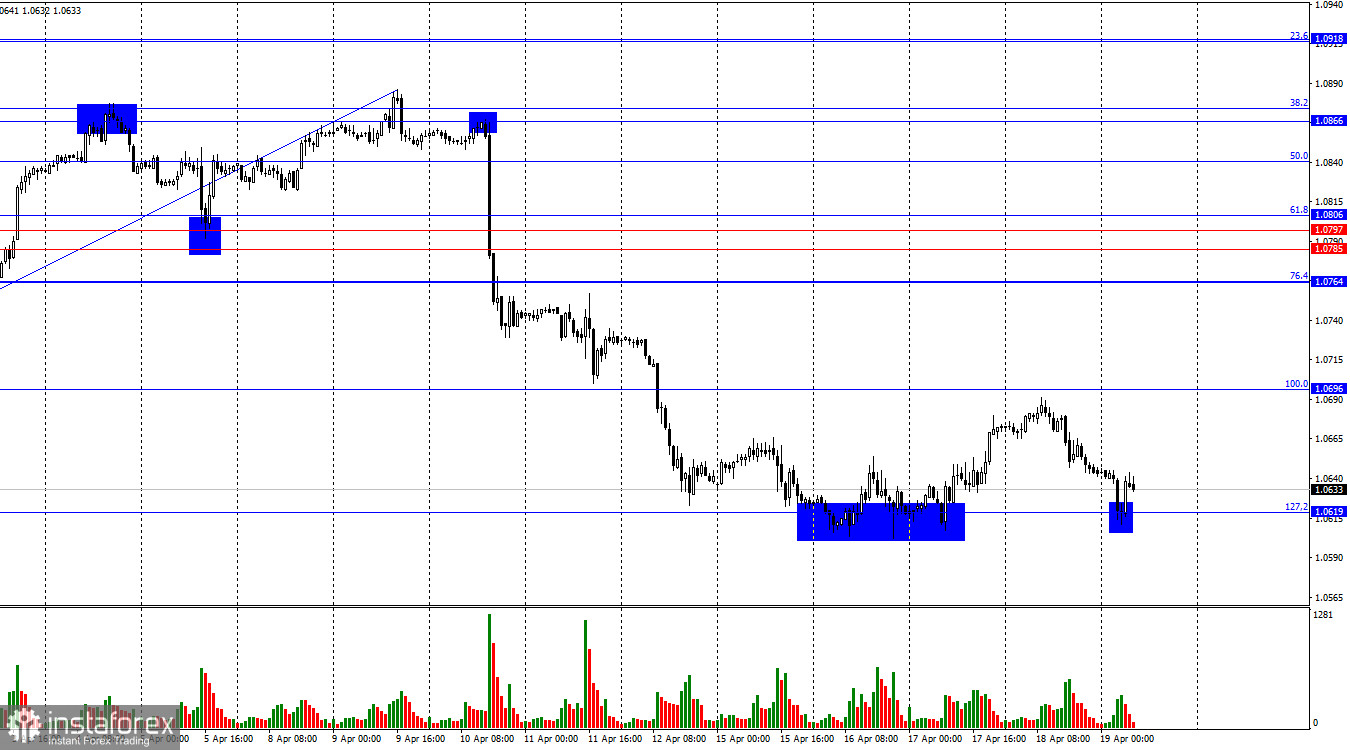

The EUR/USD pair on Thursday rose almost to the corrective level of 100.0% (1.0696) but still stopped slightly below. It made a turnaround in favor of the US currency and returned to the Fibonacci level of 127.2% (1.0619). A rebound from this level will work in favor of the European currency and lead to new growth towards the corrective level of 100.0% (1.0696). If the pair's rate remains below the level of 1.0619, the likelihood of further decline towards the next Fibonacci level of 1.0519 will increase.

The wave situation remains unchanged. The last completed upward wave failed to surpass the peak of the previous wave (from March 21st), while the last downward wave broke the last low (from April 2nd). Thus, we are currently dealing with a "bearish" trend, and at the moment there is no sign of its completion. For such a sign to appear, the new upward wave (which could have started forming the day before yesterday) must surpass the peak of the previous wave (from April 9th). Or the next downward wave (which has yet to start) fails to break the last low from April 16th.

The information background on Thursday was very weak, but some data still reached traders. In particular, in the evening, Atlanta Fed President Raphael Bostic spoke, stating that current inflation in the US is too high to consider easing monetary policy. Bostic also mentioned that inflation will return to 2%, much slower than the market expected. According to him, there is nothing bad or dangerous for the Fed to do to maintain patience regarding rate cuts. The regulator may move to ease monetary policy at the end of the year, and under certain circumstances, it may also consider additional tightening of monetary policy. In my opinion, Bostic overshadowed even Powell's speech this week. If Powell suggested not expecting easing in June, Bostic openly stated that it should be expected by the end of the year. And the Fed has yet to rule out a rate hike completely.

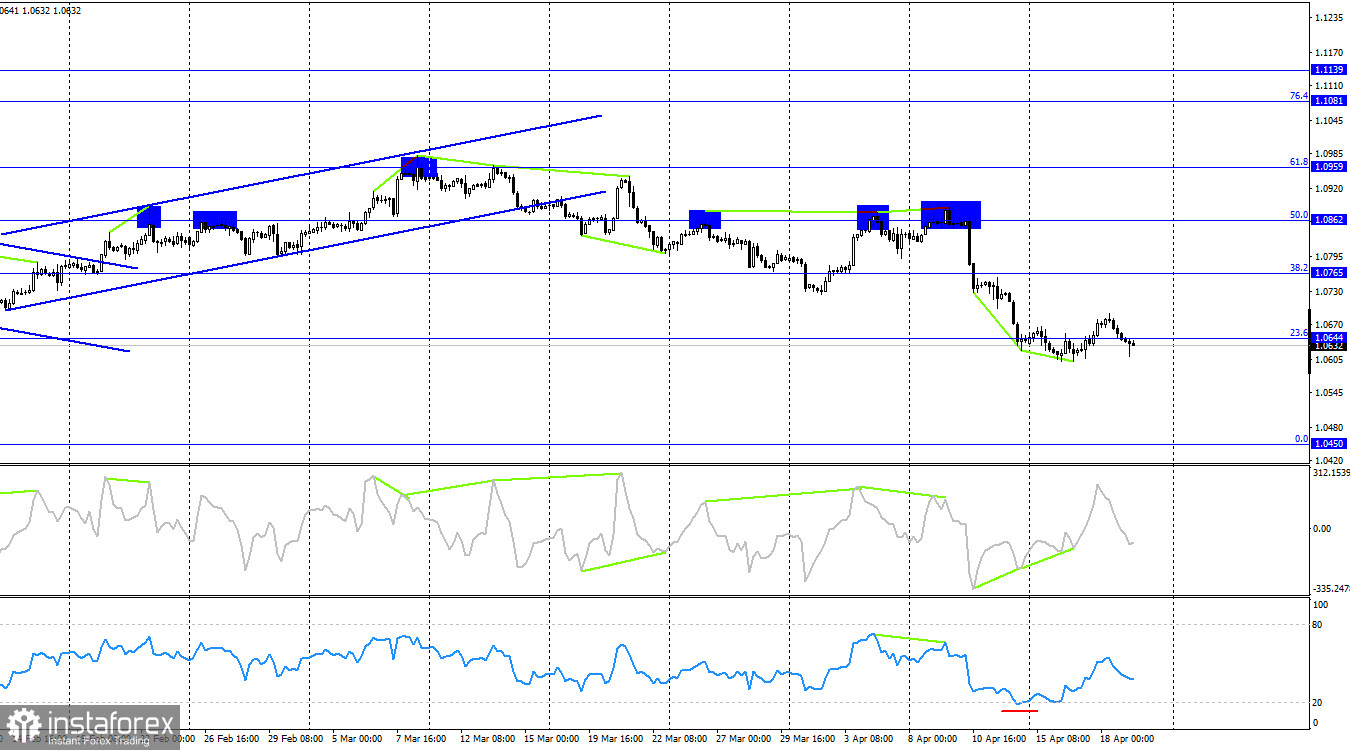

On the 4-hour chart, the pair fell to the corrective level of 23.6%-1.0644 and consolidated below it. However, two "bullish" divergences on the CCI indicator and the RSI indicator dropping below 20 worked in favor of the EU currency and initiated growth towards the corrective level of 38.2% (1.0765). If the quotes consolidate below the level of 1.0644 again, it will once again allow counting on a decline towards the next corrective level of 0.0%–1.0450.

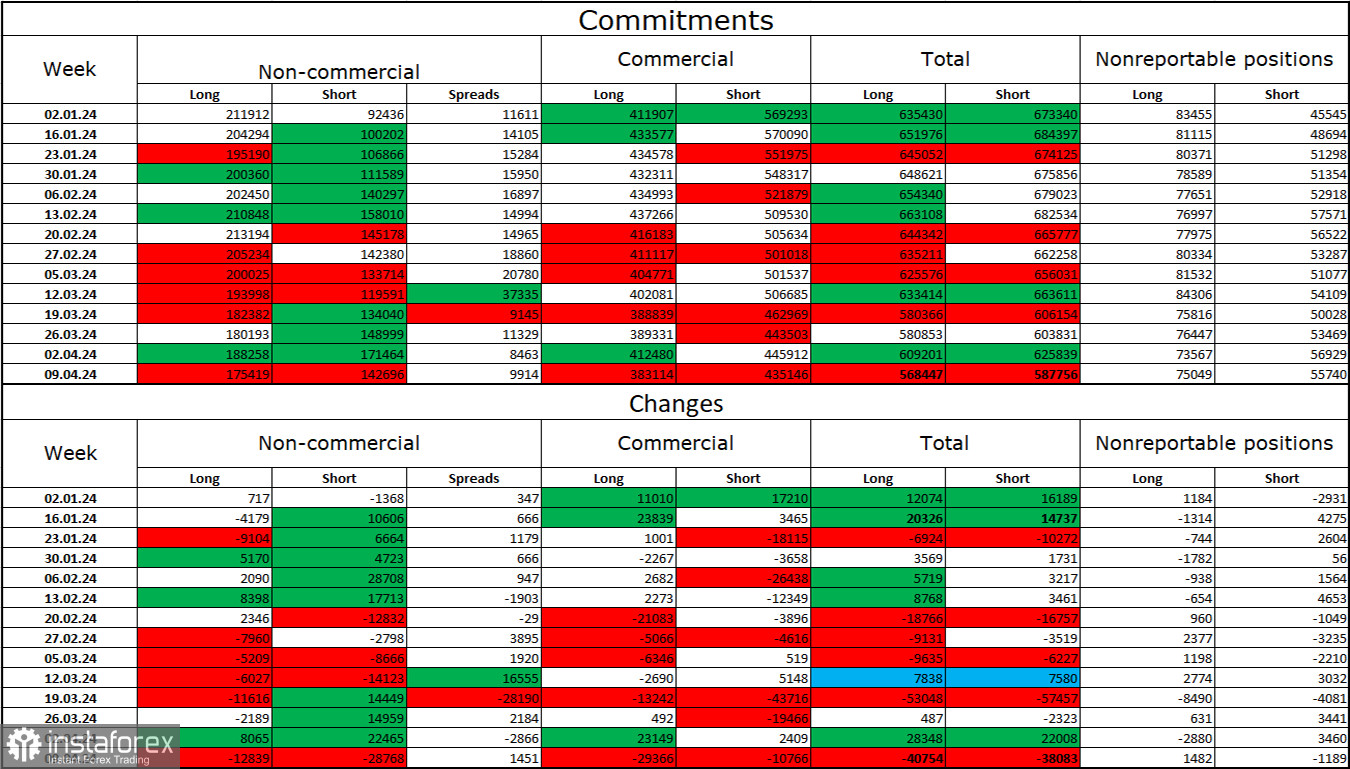

Commitments of Traders (COT) report:

During the last reporting week, speculators closed 12839 long contracts and 28768 short contracts. The sentiment of the "non-commercial" group remains "bullish" but continues to weaken rapidly. The total number of long contracts held by speculators is now 175 thousand, and short contracts - 142 thousand. The situation will continue to change in favor of bears. In the second column, we can see that the number of short positions increased from 92 thousand to 142 thousand over the past 3 months. Over the same period, the number of long positions decreased from 211 thousand to 175 thousand. Bulls have dominated the market for too long, and now they need a strong information background to resume the "bullish" trend. I don't see such a perspective in the near future.

News Calendar for the US and the European Union:

On April 19th, the economic events calendar contains a few interesting entries. The impact of the news background on traders' sentiment today will be absent.

Forecast for EUR/USD and Trader Advice:

Selling the pair is possible today if it consolidates below the level of 1.0619 on the hourly chart with a target of 1.0519. Buying the euro currency can be considered today on a rebound from the level of 1.0619 on the hourly chart with a target of 1.0696.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română