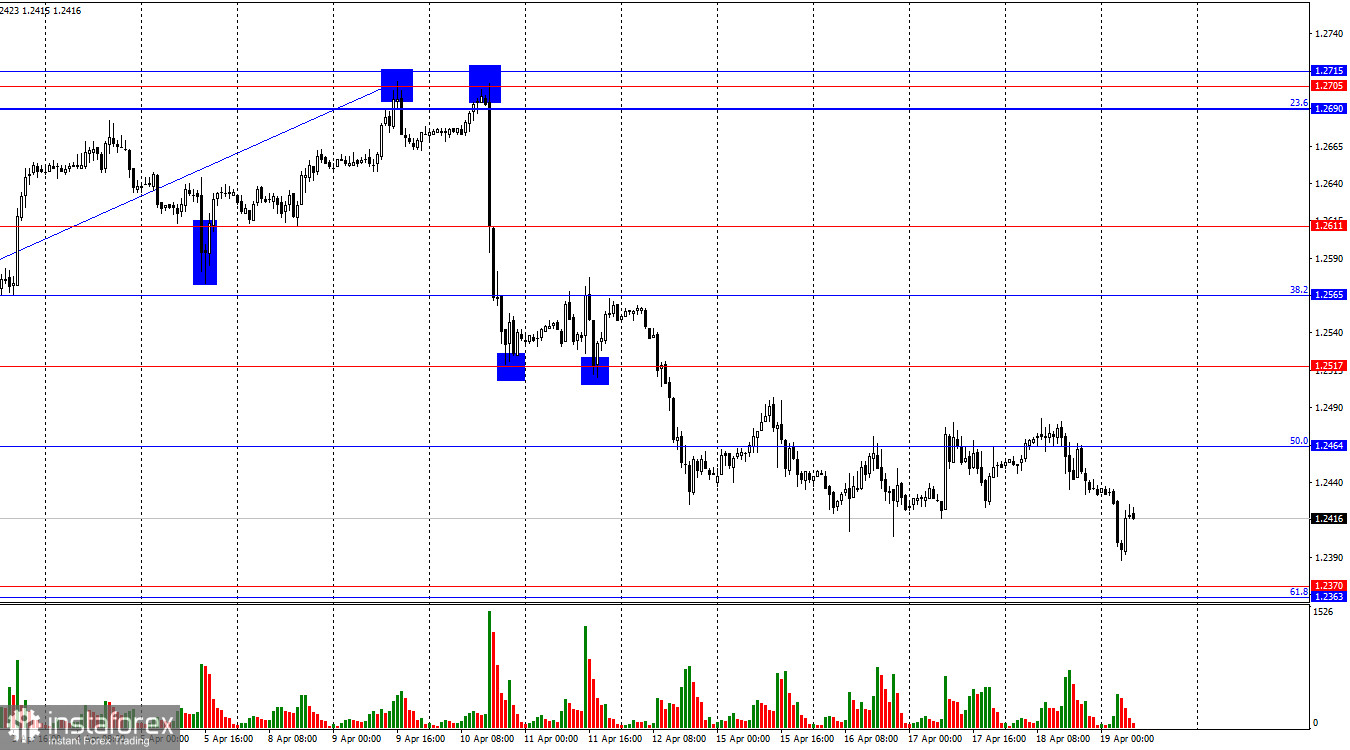

On the hourly chart, the GBP/USD pair performed another reversal this week in favor of the US currency and a slight drop towards the level of 1.2370 on Thursday. Today, a reversal was made in favor of the British dollar, and the growth process began in the direction of the Fibo level of 50.0%–1.2464. The 1.2464 level has been ignored by traders all week, and I do not expect good signals to form around it. The horizontal direction of movement has been maintained throughout the current week.

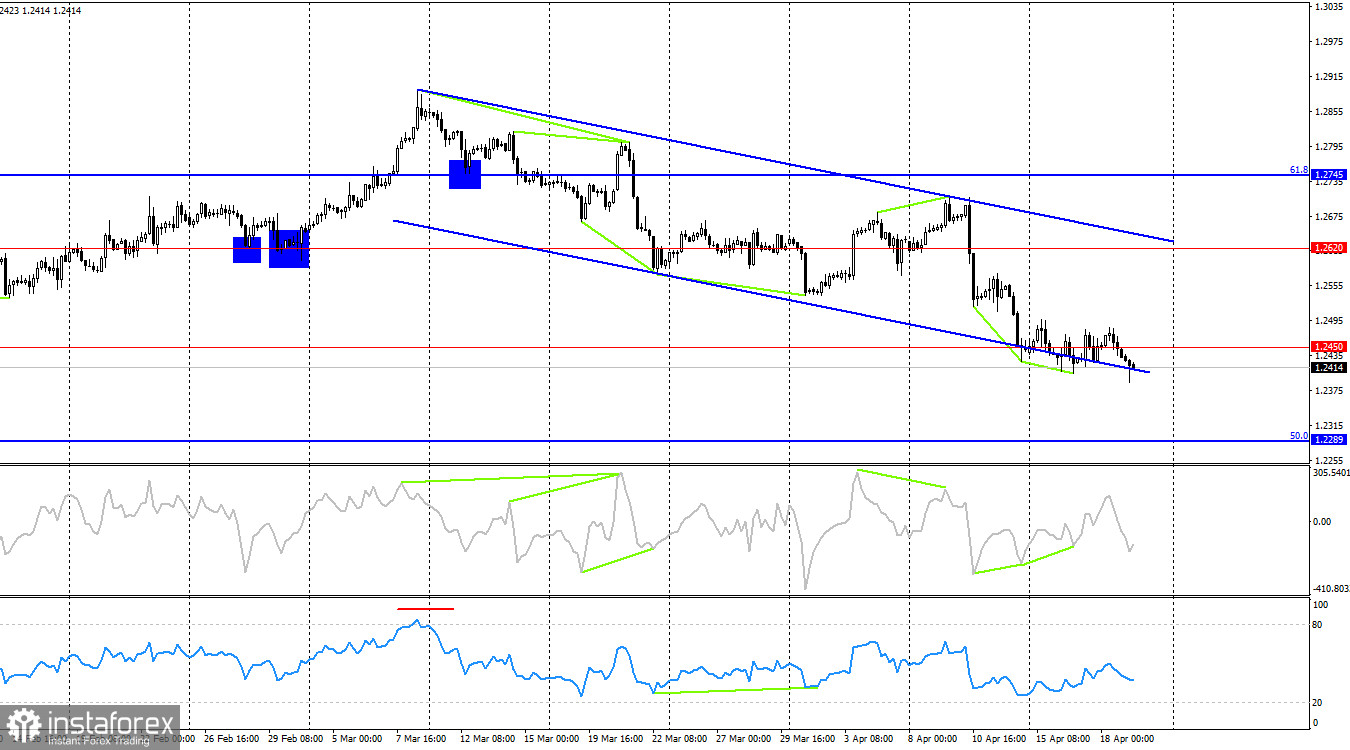

The situation with the waves still does not raise any questions. The last completed upward wave failed to break through the last peak (from March 21), and the last downward wave broke through the low of the previous wave (from April 1). Thus, the trend for the GBP/USD pair remains "bearish," and there are no signs of its completion. The first sign of the bulls going on the offensive may be a breakdown of the peak from April 9, but the bulls need to cover a distance of about 280 points to the 1.2705–1.2715 zone, which is unlikely to happen in the near future. At the moment, even the last downward wave has not completed its construction to talk about the strength of the pullback.

There were practically no important economic publications yesterday. The number of initial applications for unemployment benefits was 212K, with a forecast of 215K, and the number of new homes sold was 4.19M, with traders' expectations of 4.2M. These data did not cause any reaction from traders and did not support either bulls or bears. Today, a report on retail trade was released in the UK, the volume of which did not change compared to February, an increase of 0%. Traders expected a higher value. Despite this, the pound grows in the morning, which is not surprising in the conditions of the sideways. With horizontal movement, bulls and bears are in relative equilibrium, constantly pulling the rope in their own direction. We also see a picture of a "nervous tick" on the charts when the pair constantly changes direction of movement, remaining in the same zone.

On the 4-hour chart, the pair performed a reversal in favor of the British after the formation of two "bullish" divergences at the CSI indicator. Thus, the growth process may continue for some time in the direction of the 1.2620 level. The downward trend corridor characterizes the current mood of traders as "bearish," which allows us to expect new bear attacks. Bulls can only count on a small increase within the channel.

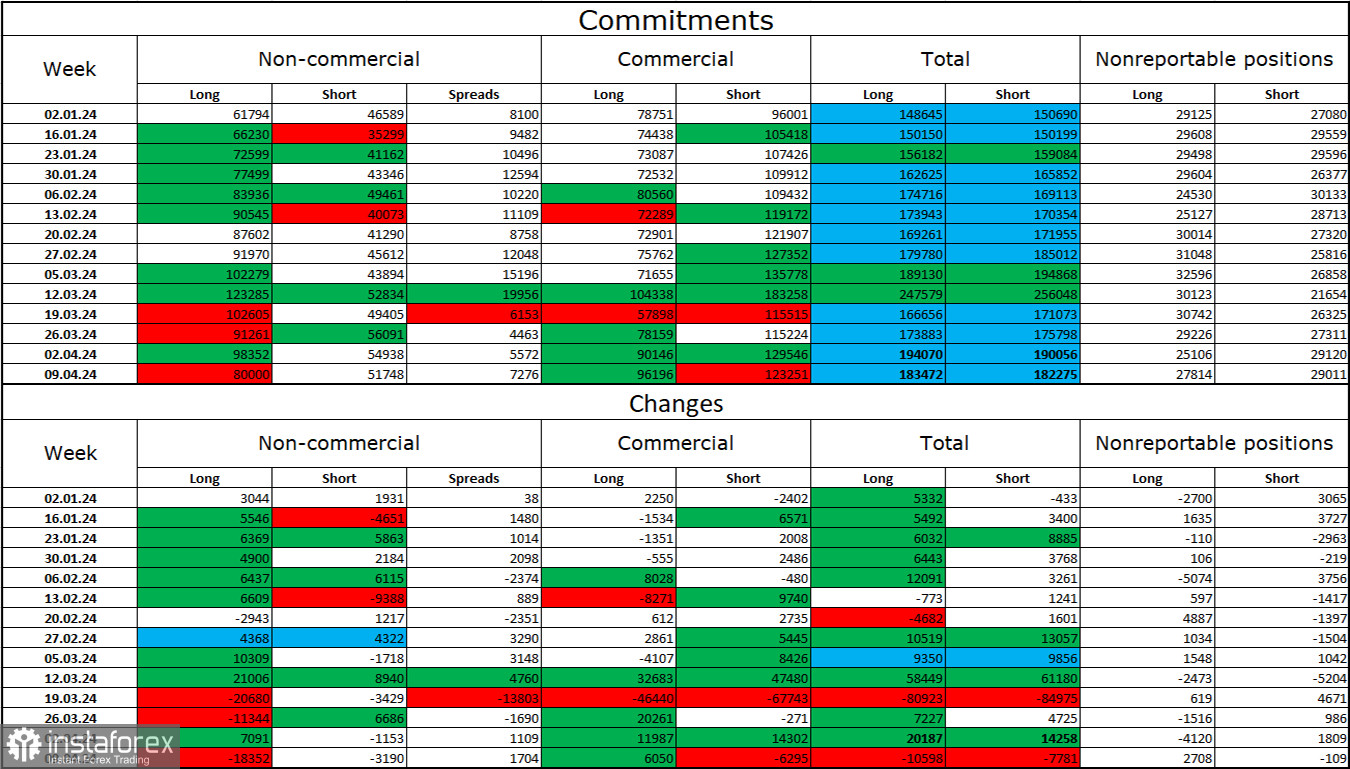

Commitments of Traders (COT) Report:

The mood of the "non-commercial" category of traders has become less "bullish" over the last reporting week. The number of long contracts in the hands of speculators decreased by 18,352 units, and the number of short contracts decreased by 3,190 units. The general mood of the major players remains bullish but has been weakening in recent weeks. The gap between the number of long and short contracts is already less than twofold: 80 thousand versus 52 thousand.

In my opinion, the prospects for a fall remain in front of the British pound, but over the past 3 months, the number of long has increased from 61 thousand to 80 thousand, and the number of short has practically not changed. I believe that over time, the bulls will begin to get rid of buy positions since all possible factors of buying the British pound have already been worked out. The bears have shown their weakness and complete unwillingness to go on the offensive in the last few months, but the US inflation report could give them confidence and strength.

News calendar for the USA and the UK:

United Kingdom – Change in retail trade volumes (06:00 UTC).

On Friday, the calendar of economic events contains one entry that has already become available to traders. The influence of the information background on the market mood today will be absent for the rest of the day.

GBP/USD forecast and tips for traders:

I don't see any potential signals for British sales today. Purchases are more interesting today, but the British dollar's growth potential is limited, the information background is weak, and traders have been ignoring the 1.2464 level for several days in a row. I think today is not the best day to search for trading signals.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română